The curve that broke our feeds

Last week, I received yet another WhatsApp message from a business I barely remembered interacting with. As I swiped it away with mild annoyance, it struck me - this feeling mirrors what happened with Facebook, Instagram, and countless other platforms I once loved. What starts as a delightful connection inevitably morphs into commercial saturation.

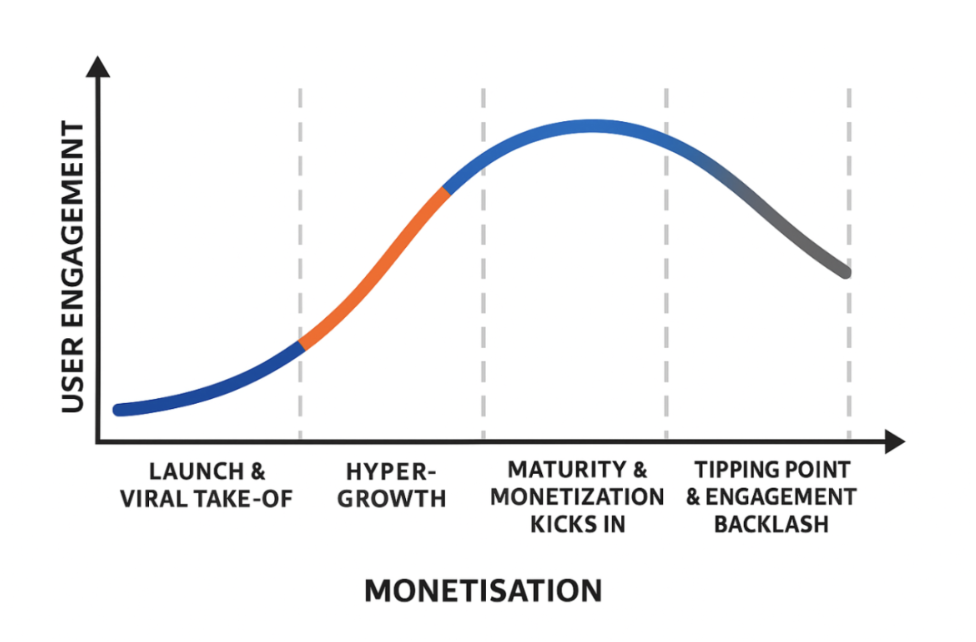

This pattern has played out so consistently in social apps that we’ve come to call it the "Feature-Monetisation-Engagement Curve". Understanding it offers valuable insights for founders navigating the consumer tech landscape.

This newsletter is authored by Radika and Amani.

The lifecycle of consumer platforms

The story always unfolds similarly:

First comes love: Every successful platform starts by delivering undeniable value. Think of Facebook’s News Feed in its early days, or Instagram’s original photo filters, or WhatsApp’s seamless and free global messaging. These products solved real problems and grew organically.

Then comes scale: As user growth skyrockets, platforms pour energy into building more unique features. Facebook launched groups, events, and a marketplace. Instagram introduced stories, and then reels. WhatsApp layered on video calls and community groups. These features drive more engagement, more sessions, and as a result, more time in-app.

Then comes monetisation: Eventually, the pressure to generate revenue kicks in. Ads start to appear subtly, and soon relentlessly. This can be seen when Facebook shifted from sidebar ads to feed-based sponsored content, or when Instagram began weaving brand promotions between friends' posts. As monetisation ramps up, organic reach shrinks, and algorithms prioritise what's profitable over what's personal.

Finally comes the crash: At some point, a line is crossed. Too many ads, too many features, but producing too little joy. This tipping point is what we like to call the User Engagement Saturation Point - where the experience feels less like a community and more like a marketplace.

Who gets it right?

The rare platforms that buck this trend aren’t necessarily ad-free. They’re just smarter about aligning monetisation with genuine user value, often by keeping the free experience robust while offering clear, optional upgrades or creator-supported models.

One such example is YouTube, as it offers an entirely free and ad‑supported video platform with skippable ads and no hard paywall. Users who want an uninterrupted experience can subscribe to YouTube Premium (≈ $11.99/month) for ad-free viewing, background play, and offline downloads, but the core free offering remains compelling and accessible.

Even Substack empowers writers to build free audiences through no‑cost newsletters, then optionally ask readers to subscribe (typically $5–$10/month) for bonus content, community chats, or Q&As. With no platform ads and a transparent creator‑support model (creators keep ~90% of revenue), readers feel their payments directly sustain the content they love.

These platforms demonstrate that sustainable monetisation doesn’t have to undermine engagement. By keeping their ‘‘free’’ layers enjoyable and clearly separating paid enhancements, they treat user attention as a renewable resource rather than an extractive one. The most user-loved platforms in 2025 are designing monetisation strategies around enhancing community engagement rather than extracting maximum short-term value.

Signals of "Too much monetisation"

If you're building a consumer app, here are some critical metrics to monitor:

DAU/MAU ratio drops: This indicates users are visiting less frequently, suggesting diminishing value.

Time-per-session declines: Your users are either logging in less often or bouncing faster when they do visit. Both indicate waning interest in the experience you're providing.

Churn rate accelerates: Both new and previously active users begin exiting at higher rates, which suggests the fundamental issues with the platform's value proposition.

Ad-revenue per user outpaces engagement: When monetary metrics climb even as usage metrics decline, you're extracting more value than you're providing which is typically an unsustainable pattern.

In the end, the Feature-Monetization-Engagement Curve isn't some immutable law. It's simply the path of least resistance in an industry that's still learning how to move from extractive growth to regenerative relationships. The founders who grasp this distinction are reshaping how value is created in the digital age.

These are the products we’ll still be using (and loving) ten years from now.